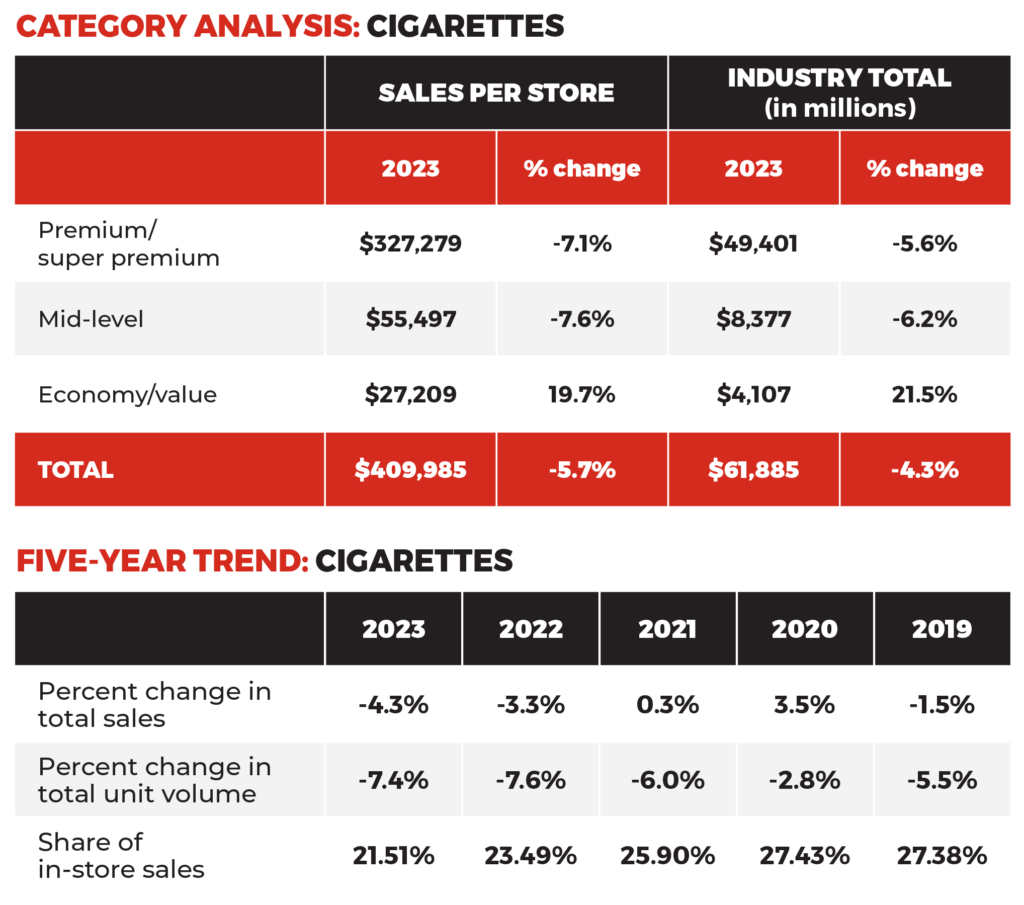

Cigarettes

For the second consecutive year, Cigarette sales have decreased in the convenience channel, with 2023 witnessing a 5.7% decline in average sales per store, dropping to $409,985. This trend highlights a significant shift in consumer behavior, particularly as the economy/value segment of Cigarettes emerged as a bright spot, growing by 19.7% to $27,209 in average sales per store. This growth suggests that smokers are increasingly looking for more affordable options, although this segment remains the smallest in terms of actual dollar sales.

In contrast, the premium/super premium Cigarette segment, which generated $327,279 in average sales per store, and the midlevel segment, with $55,497, led the category in dollar sales. However, both segments experienced a decline in per-store sales, each falling by more than 7%. Overall, the total industry dollar sales of Cigarettes fell by 4.3% in 2023, with total unit volume decreasing by 7.4%, marking the second-largest drop in the past five years. Consequently, Cigarettes’ share of in-store sales reached a new five-year low of 21.51%, down from 23.49% the previous year.

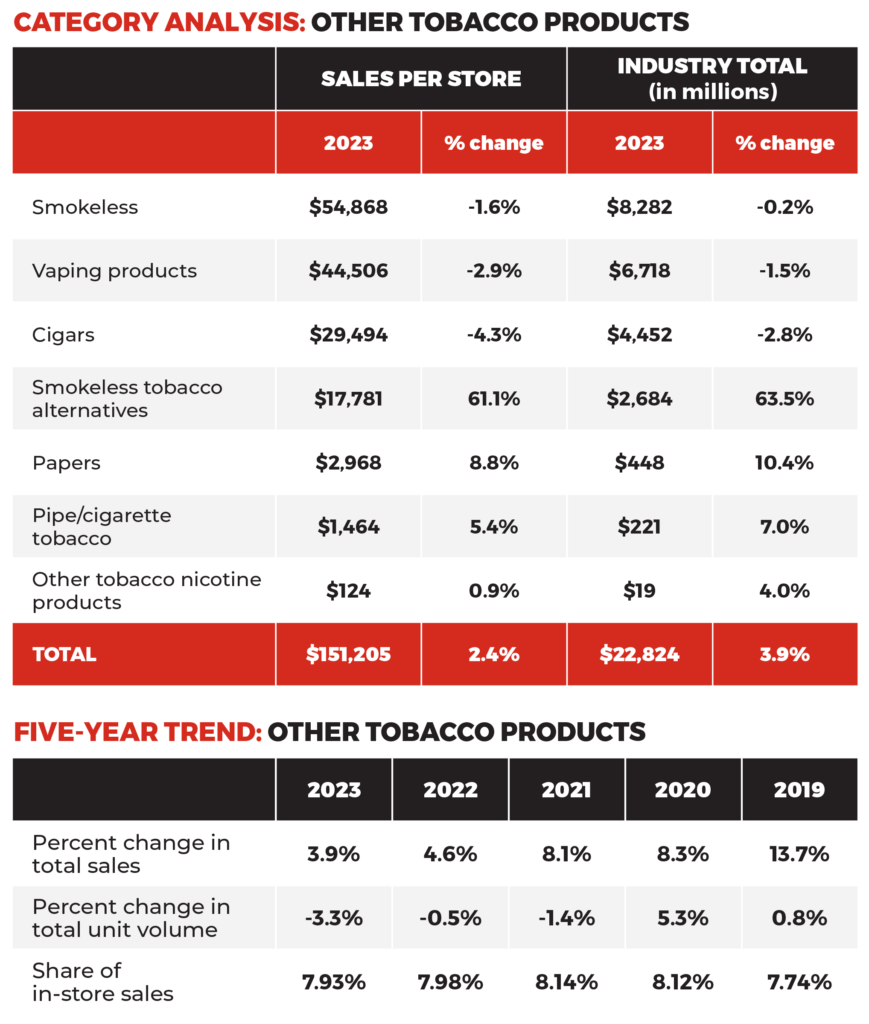

Other Tobacco Products

Other Tobacco Products (OTP) fared better than Cigarettes in 2023, albeit with a noticeable slowdown. Average dollar sales per store for OTP increased by 2.4% to $151,205, a decline from the 4% growth seen in the previous year. The top three segments in this category — smokeless tobacco, vaping products, and cigars — all saw a decrease in average dollar sales. However, the smokeless tobacco alternatives segment stood out with a remarkable 61.1% increase in sales per store, building on the 46.2% growth it achieved in 2022. Other segments, including papers, pipe/cigarette tobacco, and other tobacco nicotine products, also saw growth, though they remain low in actual dollar sales.

Total industry sales of OTP increased by 3.9% last year, slightly down from the 4.6% growth in 2022. The total unit volume dropped by 3.3%, compared to a 0.5% decrease the previous year. OTP’s share of in-store sales held steady at 7.93%.

Retailers Will Need to Adjust Strategies to Meet Evolving Demands

The tobacco industry in convenience stores is undergoing notable changes, with a clear trend towards more affordable Cigarette options and a slow but steady growth in Other Tobacco Products. While Cigarette sales continue to decline, particularly in premium and midlevel segments, the rise in economy/value Cigarettes and smokeless tobacco alternatives indicates shifting consumer preferences. As the market adapts to these trends, it will be crucial for retailers to adjust their strategies to meet the evolving demands of their customers.

Source: Hanson, Angela and Linda Lisanti. “A Trying Year: Inflation, Higher Operating Costs and Lower Fuel Prices Took Their Toll in 2023.” Convenience Store News, Industry Report 2024