By: Jennifer Childers | McLane Company Category Data Analyst

On October 28, Jennifer Childers, Spencer Webb (McLane Confection Category Manager) and Jill Williams (McLane Merchandising Specialist), reviewed the 12-foot inline candy set and the eight-foot peg set with representatives from the vendor and broker communities including; Mars, Hershey, Mondelez, Ferrara, Ferrero, Promark, Crossmark, A C Central and Advantage.

Together, we examined the Confection category trends and broke it down into segments. IRI, Nielsen and McLane data were all used in the discussion. The review included refreshment, chocolate and non-chocolate. We used the insights to adjust the planogram (POG) item mix, including pull and plugs for low performing items and items impacted by supply chain issues. As a result, we created a POG to help McLane customers grow the category with a stronger mix and with recommendations for items that will keep retailers’ shelves full.

Refreshment

To start the day, we looked at the Refreshment segment including gum and mint. Hershey data showed Refreshment is trending up at 14%. Within Refreshment, Gum is trending up 16% in dollars and Mints is trending up 6.8%. Share of space for Refreshment in an instant consumables (IC) set is Gum at 32% and Mint at 7%, according to Mars.

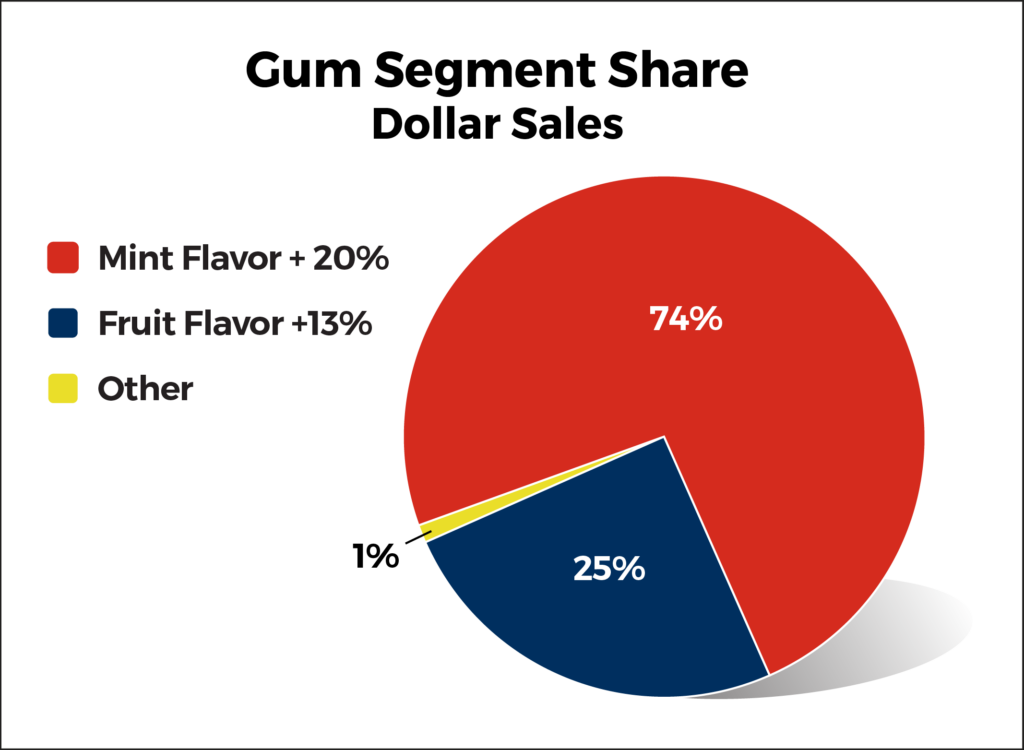

Diving deeper into the Gum segment, we found the growth is driven by an increase in sales of mega packs and bottle packs. This quarter has shown an uptick in single packs sales with a 12% increase, though this is still below pre-pandemic levels. Fruity flavors in Gum and Mints have seen an increase in sales, with mint flavored gum maintaining the largest share. Within Gum, fruit flavors are up 13% in dollars, while mint flavors are up 20% in the last 26 weeks, according to Hershey. Mint flavor gum holds 74% share and fruit holds 25%. Mars noted that this year’s innovation is mainly fruity flavors, attributed to a change in shopper habits during the pandemic. Shoppers began to chew gum and eat mints as a treat or for enjoyment, choosing fruity flavors more often, rather than to freshen their breath during the workdays. Gum and Mints have been an impulse category, and continue to be, though Mondelez stated they are seeing an increase in planned purchases as customers look for value due to inflation.

Looking at the mint segment, standard packs are outpacing larger packs, unlike gum, according to Crossmark. Ferrero stated that within mints, fruity is trending up 13% and mint is trending up 4%. Hershey added that berry flavor is the biggest contributor to the fruit category and that sour flavored mints are trending down.

Merchandising of the Refreshment segment is based on the trends above. The decision was made to lead the aisle with Gum starting with mega and bottle packs, then standard gum, and anchoring the aisle with mints. Mars’ data suggests mints at the end of the aisle creates an invitation for customers coming from the back of the store to impulsively shop IC. Also, having mints over fruity creates an adjacency to the fruity segment with the candy rolls in the mints segment. In a test store, where Mars implemented this strategy, they did not see a decrease in mint sales.

Instant Consumables Confection

IC Confection has remained strong as a top performing c-store category throughout the last three years. According to Mars, Chocolate is seeing 11% dollar growth and a decrease of 4.5% in units as price increases continue. Non-Chocolate is up 4.9% in dollars and down 7.8% in units. King-size bars hold as the king of dollars for both Chocolate and Non-Chocolate. Standard size in Non-Chocolate outpaces king size when looking at units. Innovation has slowed as core items have become a major focus due to supply issues. Innovation continues to be in king size over standard.

Peg Candy

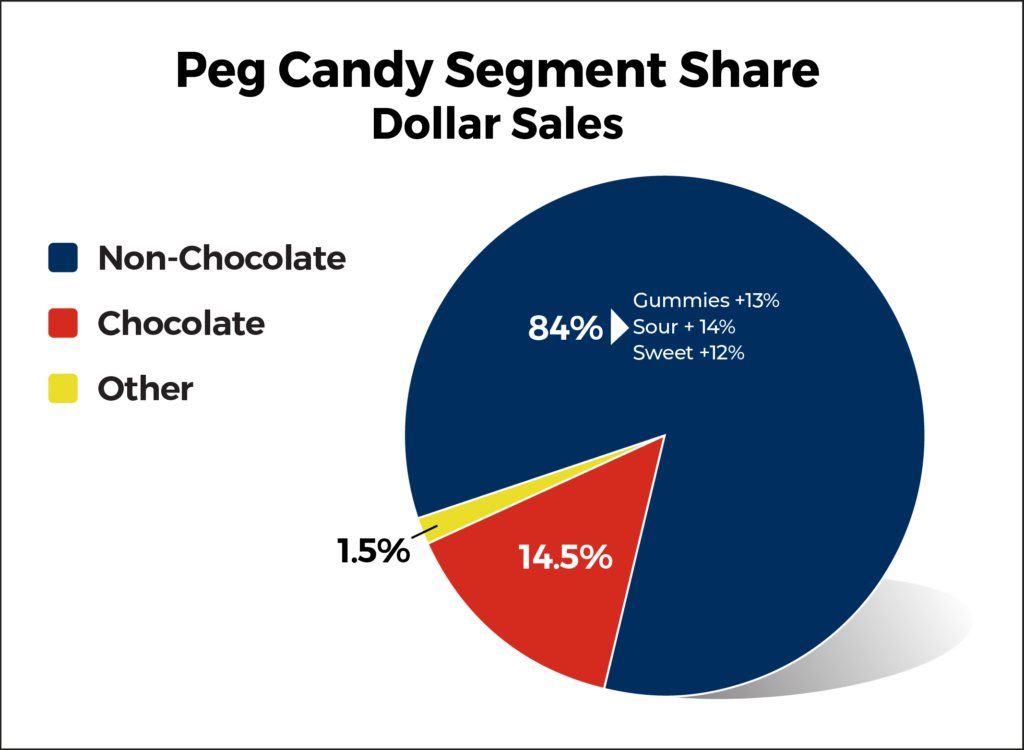

Peg Candy is seeing significant growth at 13% in dollars and is flat in units. This segment continues to be predominantly Non-Chocolate with an 84% share and chocolate holding a 14.5% share, according to Hershey. Within Non-Chocolate, gummies are the largest contributor to growth and share of space, with an increase of 13% in dollars followed by sour at 14% and sweet at 12%.

View the most recent Candy/Gum/Mint 12ft Strike Zone POG.

View the most recent Candy/Gum/Mint 12ft Over-Under POG.