By: Jennifer Childers | McLane Company Category Data Analyst

In the realm of snacks, the landscape is ever-evolving, with consumers constantly seeking out new and innovative options to satisfy their cravings. Whether it’s a breakfast kickstart, a mid-afternoon pick-me-up or a post-workout refuel, the choices seem endless.

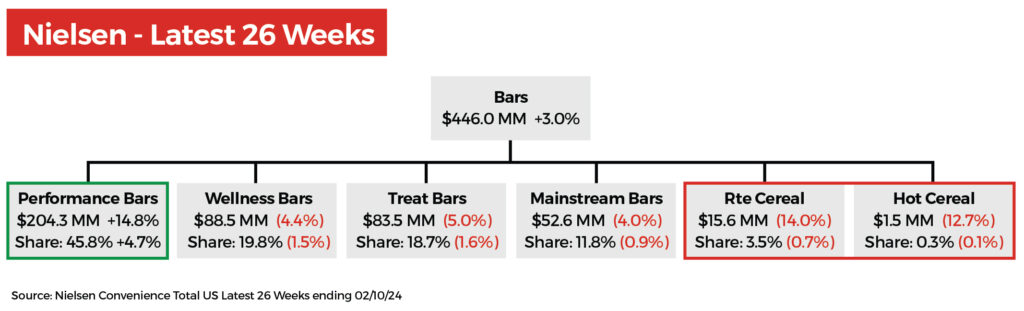

Looking at the latest trends in the cereal bars category, recent data shows dollars are up 3.0% compared to last year. However, there’s a slight dip in units, down by -5.1%. What’s driving this growth? Performance bars seem to be leading the charge, while traditional RTE (ready-to-eat) and hot cereals are experiencing declines.

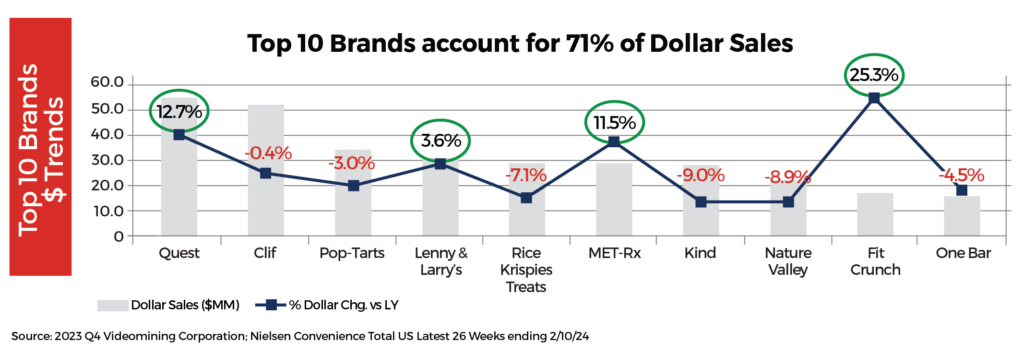

When it comes to performance bars, four main brands dominate the market, collectively accounting for over half of the dollar sales. Quest, Lenny & Larry’s, MET-Rx, and Fit Crunch are the heavy hitters in this arena, with Fit Crunch taking the lead with a whopping 25.3% share.

So, what’s the scoop on consumer preferences in this category? According to Kirk Bailey, Senior Manager, McLane Strategic Supplier Programs, flavor and taste still reign supreme. Consumers want snacks that not only fuel their bodies but also tantalize their taste buds. Bailey points out “indulgence in bars has been seen over the last few years with suppliers blurring the lines with their ‘sweet’ competitors.”

But it’s not just about flavor – protein is also stealing the spotlight. “Protein, protein, protein is big in this category as more consumers look for different ways to fill their protein needs,” says Bailey. As more consumers prioritize protein intake, they’re turning to snacks as a convenient way to meet their nutritional needs.

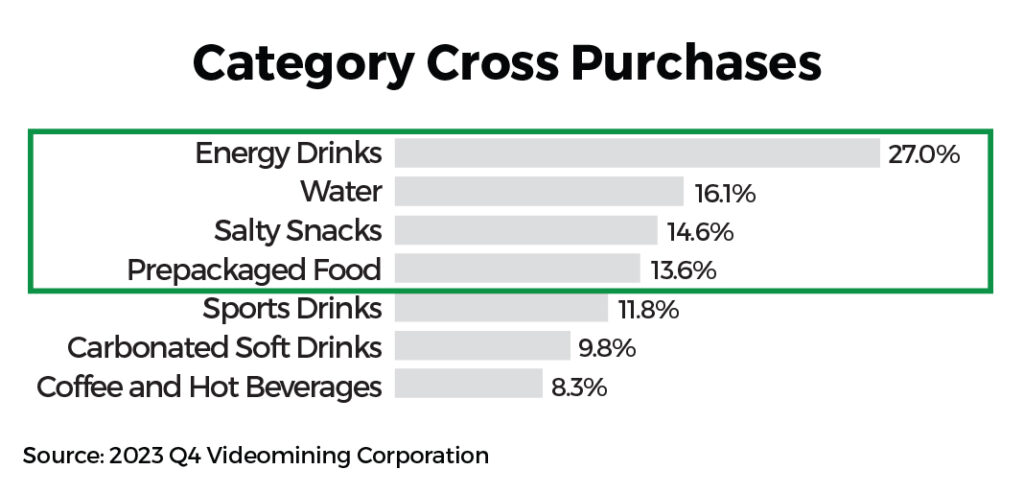

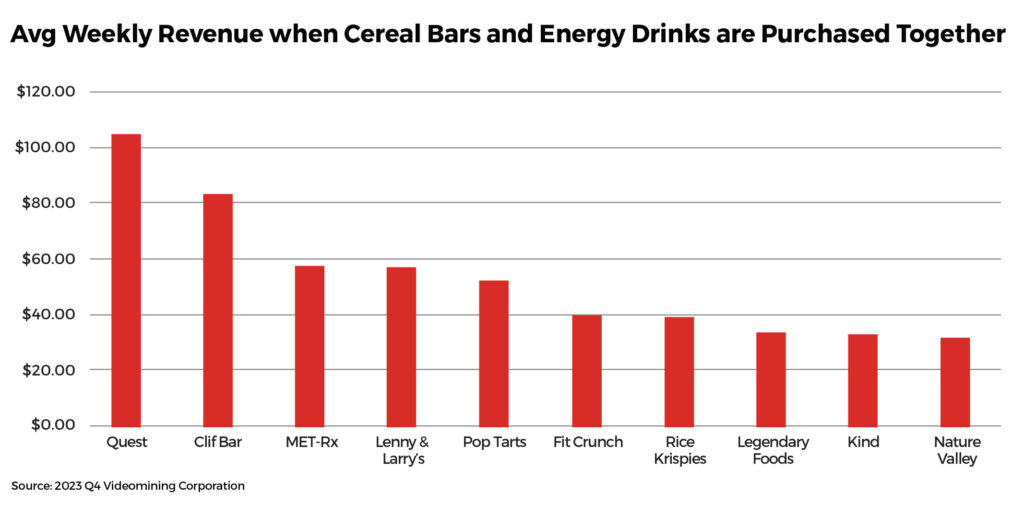

MET-Rx seems to have found its niche, often purchased alongside energy drinks, although its average weekly buyers suggest a broad appeal beyond this pairing. Interestingly, the top 10 brands purchased with energy drinks command a staggering 70% of the revenue, highlighting the symbiotic relationship between these products.

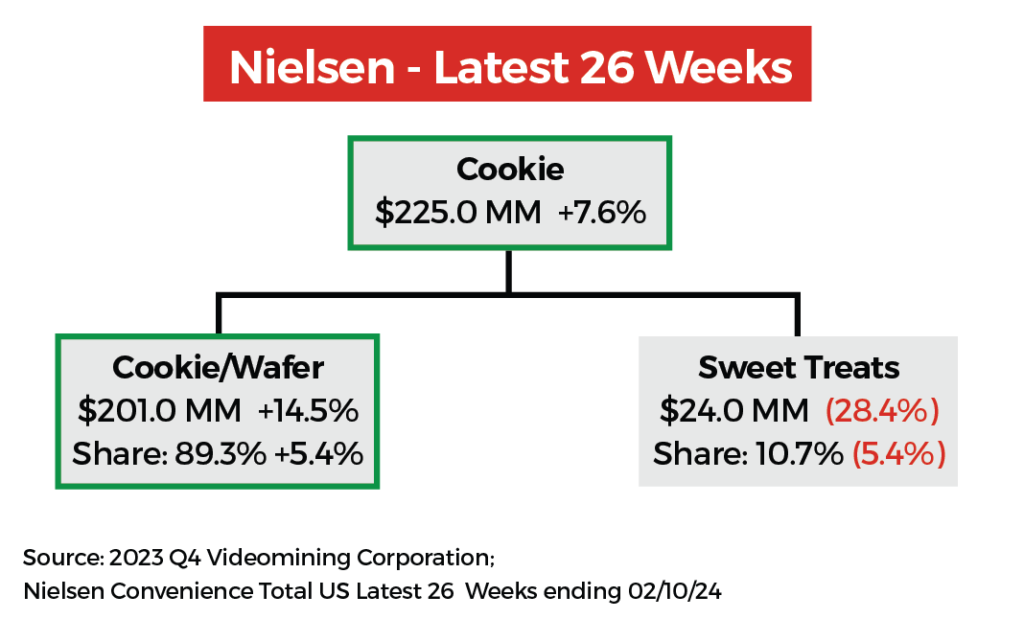

But what about those who prefer their snacks in the form of cookies? According to recent data, cookies have experienced a notable uptick in sales, with a significant 7.6% increase compared to the previous year. However, despite this surge in demand, unit sales have seen a decline of 7.0%. So, what’s driving this growth in dollar sales? The answer lies in inflation, which has played a pivotal role in boosting the overall revenue of the cookies category.

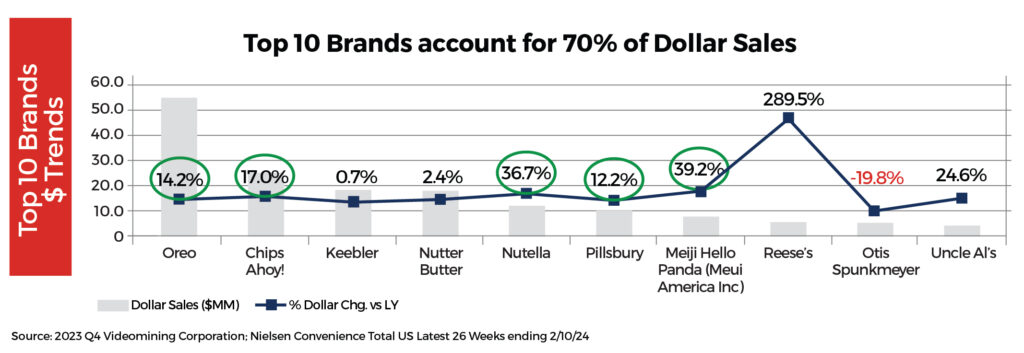

Delving deeper into the numbers, it’s evident that certain brands are leading the charge in this upward trajectory. Remarkably, 9 out of the top 10 brands have shown growth compared to the previous year. Among the frontrunners driving this growth are household names like Oreo, Chips Ahoy!, Nutella, Pillsbury, and Hello Panda.

Despite the diverse array of options available, a select few brands dominate the market, accounting for a staggering 86% of total weekly revenue. Even more striking is the fact that the top 10 brands alone contribute to 70% of dollar sales, underscoring their undeniable popularity among consumers.

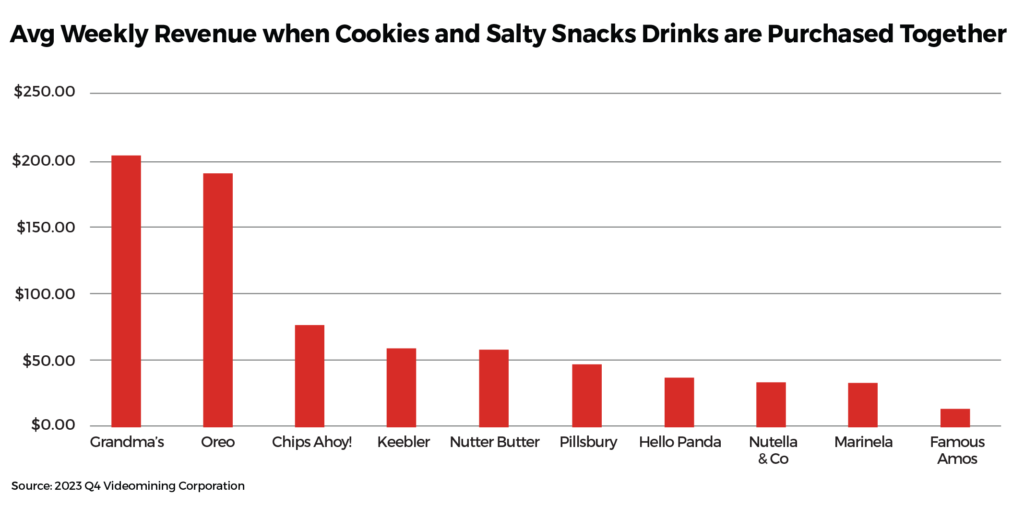

One particular standout in this landscape is Nutella & Go, a delightful combination of creamy Nutella and crunchy breadsticks. While it’s most commonly purchased alongside salty snacks, its weekly buyer count remains relatively low. Nevertheless, when paired with salty snacks, the top 10 brands collectively rake in a whopping 93% of revenue, highlighting the strong synergy between these complementary categories.

For c-stores looking to capitalize on the snack market, now is the time to take note. Shoppers are seeking quick energy boosts, meal replacements and delicious pick-me-up treats on the go so. Data shows that stocking up on the top sellers is key as they account for a large portion of dollar sales.

For McLane’s latest item suggestions, refer to our 8ft Cookie/Cracker/Nutritional planogram.