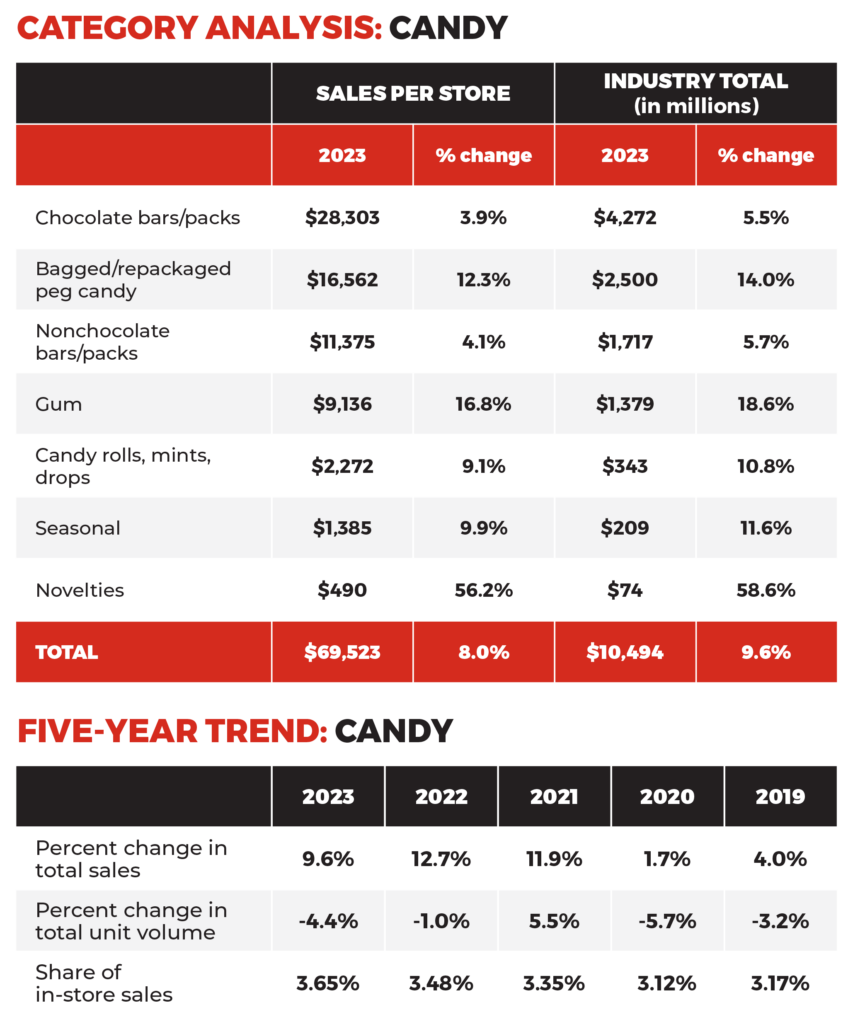

2023 was a fairly sweet year for the Candy category, with all segments seeing growth despite a slight deceleration compared to the previous year. Average sales per store increased by 8% to $69,523, a step down from the 12% growth seen in 2022.

For the second year in a row, gum posted the largest percentage increase at 16.8%, excluding the relatively small novelty candy segment. Chocolate bars and packs, the top-selling segment, saw a 3.9% growth in per-store sales, a decline from the 9.9% growth observed the previous year. Bagged and repackaged peg candy, which is the runner-up in terms of dollar sales, experienced a 12.3% increase, down from a 14.7% growth in 2022.

The Candy category appears to be particularly buoyed by inflation, as 2023’s healthy 9.6% growth in total industry sales masked a 4.4% decline in total unit volume. The category’s share of in-store sales increased by less than a percentage point to 3.65%.

The candy category has shown resilience and adaptability in the face of economic fluctuations, with inflation playing a significant role in driving sales growth despite a decline in unit volume. As consumer preferences and economic conditions continue to evolve, the candy industry remains poised for ongoing success.

Source: Hanson, Angela and Linda Lisanti. “A Trying Year: Inflation, Higher Operating Costs and Lower Fuel Prices Took Their Toll in 2023.” Convenience Store News, Industry Report 2024