As 2023 began, convenience store retailers faced a trifecta of challenges: inflation, a persistent labor shortage, and volatile motor fuel prices. These concerns were well-founded, as evidenced by the performance metrics detailed in the 2024 Convenience Store News Industry Report, the longest-running annual analysis of the U.S. convenience store (c-store) sector.

After achieving record-high sales in 2022, the convenience store industry saw a decline in total sales in 2023, dropping 4.7% from $814 billion to $775.5 billion. This dip marks a significant shift after a year of robust growth, indicating the industry was not immune to broader economic pressures.

In-Store Sales: A Silver Lining

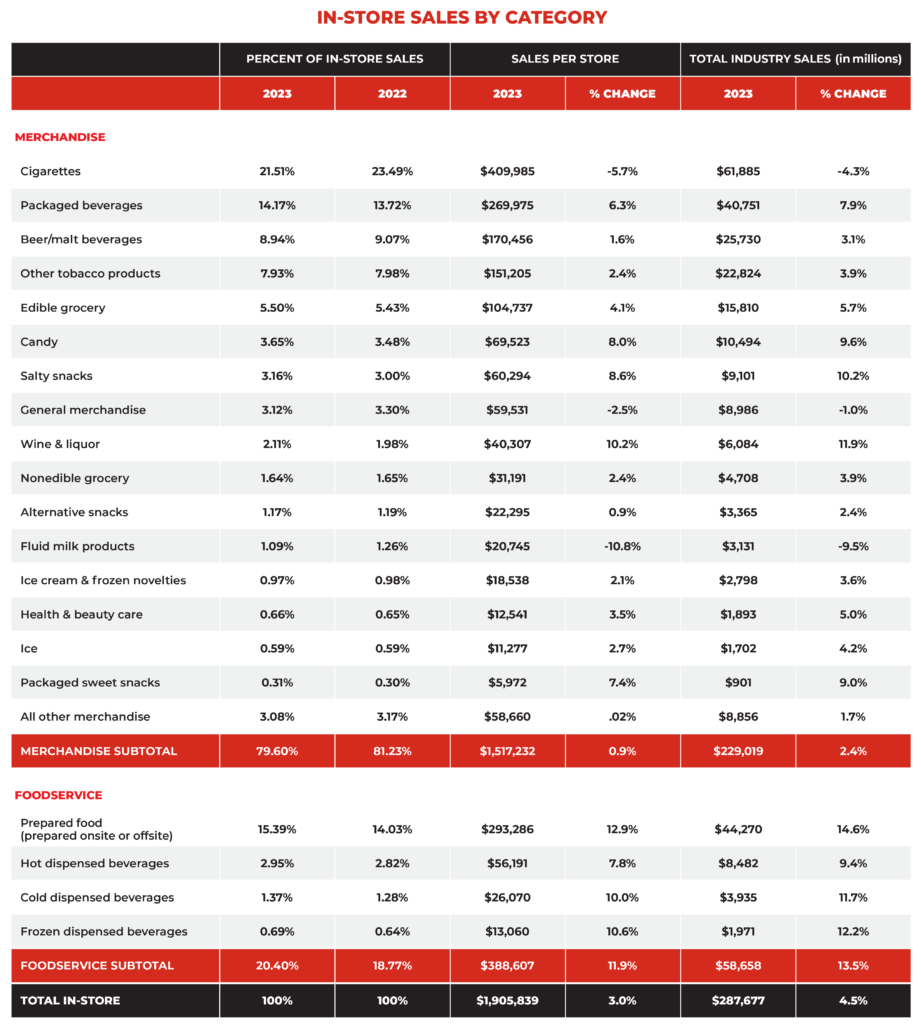

Despite the overall sales decline, in-store sales at convenience stores continued their upward trajectory, reaching a new high of $287.7 billion—a 4.5% increase from the previous year. This growth can largely be attributed to inflation, which pushed product prices higher throughout the year. The consumer price index (CPI) for 2023 was 5.7%, a slight decrease from 6.5% in 2022, yet still indicative of substantial price increases that affected consumer spending.

Additionally, the industry saw a modest expansion in the number of stores. The total store count rose by 1.5%, bringing the total to 152,396 locations. Chains account for 39.8% of these stores, while single-store operators make up the remaining 60.2%. The number of chain-operated stores grew by 1.4%, and single-store locations increased by 1.5%, showing steady but cautious growth in the sector.

Motor Fuels: A Major Setback

The primary driver of the overall sales decline was the motor fuel segment. While fuel volume saw a slight uptick with gallons sold increasing by 1.4%, lower gas prices led to a substantial 9.4% decrease in fuel revenue, which dropped from $538.7 billion in 2022 to $487.8 billion in 2023. This significant drop in revenue underscores the volatility and sensitivity of the fuel market to price changes.

Shifts in the Sales Mix

As a result of these dynamics, the sales mix within the convenience store industry shifted notably in 2023. Motor fuels still accounted for the majority of sales, but their share decreased from 66.2% in 2022 to 62.9% in 2023. Conversely, in-store sales increased their share from 33.8% to 37.1%, reflecting a growing reliance on in-store purchases as a vital revenue stream for c-stores.

Looking Ahead

The convenience store industry’s experience in 2023 highlights the complex interplay between various economic factors and their impact on retail performance. While inflation and fuel prices presented significant challenges, the steady growth in in-store sales and store counts provides a glimmer of resilience. As the industry moves forward, retailers will need to navigate these ongoing challenges while leveraging in-store sales growth to maintain stability and drive future success.

Source: Hanson, Angela and Linda Lisanti. “A Trying Year: Inflation, Higher Operating Costs and Lower Fuel Prices Took Their Toll in 2023.” Convenience Store News, Industry Report 2024