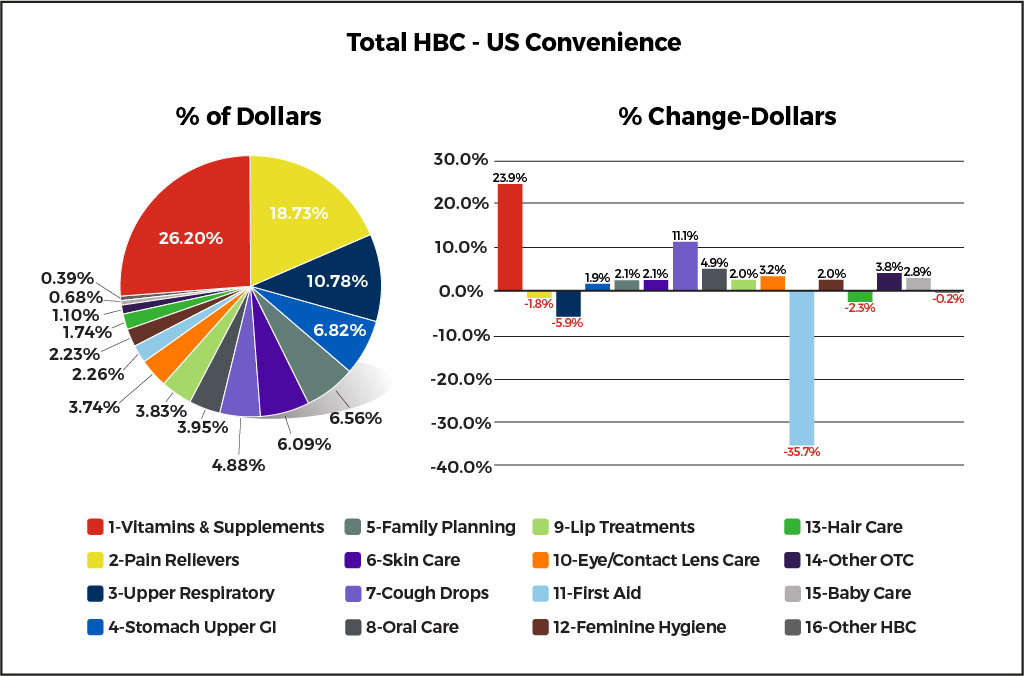

As we review the Health, Beauty & Wellness category through mid-June, we find that Dollars are +4.3% and Units -2.8%. Remove PPE and Dollars are +5.8% and Units -1.5%. While average retails increased more than 7% with or without PPE, increasing retails are making up for lost Unit growth. A positive take is that we continue to see inflation decline. After peaking at 9.1% in June 2022, the latest data shows May at 3.8%.

Category growth drivers are Vitamins & Supplements. This segment is up in both Dollars & Units and holds the largest category share along with Cough Drops and Feminine Hygiene which are ticking up due to improving supply chains.

First Aid skyrocketed during COVID but since restrictions lessened, and the pandemic ended, the segment has fallen drastically.

Vitamins & Supplements

• Dollars +24% and Units are +17.5%.

• Average retails grew by 5.5%.

Pain Relievers

• Dollars are -1.8% and Units are -9%.

• Trial Size Extra Strength Tylenol is #1 in Dollars and BC six count leads the way in Units.

• Supply chain issues with trial size Advil and Children’s Motrin are hurting performance.

• Full size (non-liquids) is showing strongest performance with the fastest growing full-size item being Lil’ Drug 50ct Ibuprofen.

• Advil 24ct has seen some trade-up due to trial-size out-of-stocks.

Upper Respiratory

• Dollars are -5.9% and Units are -12.1%.

• Supply chain issues on many items continue to adversely affect the category–NyQuil and DayQuil 8oz are both down more than -20% in both Dollars and Units[MB1] which continue to be constrained with no full recovery in sight.

• Robitussin is picking up the slack, Dollars +85% and Units +67%.

• Afrin Nasal spray is normally a top 15 item, but out of stocks has caused it to drop to #37 in total Dollars, and growth in Units and Dollars both down more than 60%.

Stomach and Upper GI

• Dollars are +1.9% and Units are -7.3%.

• Liquids are driving growth, but only 23% of category Dollars.

• #1 item is Pepto Ultra Max 4z and growing along with Pepto Original 4z (#4 in Dollars).

• #1 H2 Blocker continues to be Pepcid AC 5ct and ranks 8th in total Dollars despite supply chain problems that are expected to be solved before the end of July.

• Acid Neutralizers make up 38% of Dollars and 59% of total Units.

– Dollars are flat and Units are -7.6%.

– Tums has the top six spots in total Dollars and continues driving growth.

– Tums Brand Dollars +8.5% and Units -1.8%.

– Rolaids Dollars -19% and Units -21%.

– Tums Dollar share is up to 78% and Rolaids Dollar share now 18.9%.

– Tums Very Cherry 6ct has now become the top soft-chew option in a category where

form is top of mind for the consumer.

Family Planning

• Dollars are +2.1% and Units are -2.9%.

• Top 10 is dominated by Trojans and growth is being driven by the two Bare Skin options.

• Non-Latex continues to be underrepresented in the c-store class of trade and only accounts for 2% of Dollar share versus ~20% in FDM.

• Pregnancy Test Kits continue to show growth on top of the growth experienced during the pandemic.

• Pregnancy Test Kit Dollars are +4% and Units are +0.4%.

Skin Care

• Dollars are +2.1% and Units are -9.6%.

• Hand sanitizers are driving declines but still producing about +11% more in Dollars versus 2019 quarterly average of $1.75mm.

• The rest of the category Dollars are +6% with the number one SKU, Old Spice High Endurance driving growth: Dollars +27% and Units +12%.

• The LDSP 30ct Antibacterial Hand Wipes is #5 in Dollars and #2 in Units and continuing to show growth on top of the growth due to the pandemic and Wet One’s supply chain troubles.

Cough Drops

• Dollars are +11.1% and Units are +6.6%.

• Growth across the board for the Top 10 SKUs except for Halls Cherry Bag.

• Many SKUs are benefiting from positive stock status versus last year.

• Ricola brand continues to deliver the biggest sales gains and smaller brands are experiencing large declines.

• Item to Watch! – The new Ricola Berry Medley Bag has quickly jumped to #13 overall.

Oral Care

• Dollars are +4.9% and Units are -0.8%.

• Orajel Max is the top item in Dollars as retailers switch up to this SKU from other Orajel options.

• Listerine declines driven by supply interruptions.

• Crest Complete is top growth item.

• LDSP Toothbrush/Toothpaste Combo also saw big unit and movement growth and remains #3 in total Dollars and #1 in Units among the Top 10.

Lip Treatments

• Dollars are +2% and Units are -2.3%.

• Carmex Brand is driving Dollar growth. The annual BOGO offering has proven to be a winner for the brand, as well as retailers and wholesalers.

• Carmex Tube Dollars are +3.6% and Units are -2.6% and is #1 in both metrics.

• Burt’s Bees has been the biggest drag on performance, but supply chain improvements have seen it go from double digit declines to being up in Units and -5.2% in Dollars.

Eye/Contact Lens Care

• Dollars are +3.2% and Units are -3.3%.

• Clear Eyes 0.2 oz options account for ~60% of Dollars and Units.

• Visine 0.5 oz leads the way at the shelf and growing in both Dollars and Units.

• Opti-Free Puremoist Dollars and Units are flat after significant growth in 2021 and 2022. However, it is still earning its place as the top lens care solution for HBC sets in the c-store channel.

First Aid

• Dollars are -36% and Units are -27%.

• In total the category is down ~$6mm versus last year with Covid Test Kits (-$2.5mm) and Masks (-$2.7mm) accounting for ~90% of the loss.

• Neosporin has returned to the top spot.

• Lil’ Drug Isopropyl Alcohol is showing the biggest growth among items traditionally found in sets pre-pandemic, Dollars +37% and Units are flat.

Feminine Hygiene

• Dollars are +2% and Units are -9.4%.

• The Top 10 has been shaken up due to ongoing supply chain issues across nearly all SKUs.

• Finding an item in a “positive stock status” position is currently the number one attribute when making planogram decisions.

• Playtex is the fastest growing brand.

Hair Care

• Dollars are -2.3% and Units are -6.2%.

• Private Brand 2ct Razors are #1 and #4 (Lil’ Drug version) are both driving growing.

• Head & Shoulders is the #2 overall SKU in total Dollars and driving growth, Dollars +32% and Units +25%.

Other OTC

• Dollars are +3.8% and Units are -2.6%.

• Dramamine holds three of the top 10 spots and brand is up 4.5% in Dollars.

• ZzzQuil Dollars are -6% and Units -7%.

• NoDoz 6ct has jumped to #4 in Dollars and #2 in Units with double-digit growth aided by new distribution and tailwinds from supply chain constraints last year.

Baby Care

• Dollars are +2.8% and Units are -1.9%.

• Seven of the top 10 items in Dollars and Units are baby wipes. They make up nearly half of Dollars and Units in the category and are the most productive SKUs on a per store basis.

• Johnson’s Baby Oil 3oz checks in at #4 and the best diaper option, Pampers Size 4 Changing Kit, is #8 in total Dollars.

Other HBC

• Dollars are -0.2% and Units are -4.2%.

• Cotton Swabs make up nearly two thirds of Dollars and 58% of Units.

• Nail Clippers are the bright spot, only 15% of Dollars but over 25% of Units. Nail Clipper Dollars are +9% and Units +7%.

According to a CSN 2023 Industry Report, 88% of consumers are willing to try different products and services due to price pressures. This isn’t shocking since the #2 reason (just behind “bad experience”) for switching away from a brand is price increases. Look for private label lines to benefit as the savings accounts that grew during the pandemic dwindle and consumers feel the pressure of less spending power. Be sure to stock up on HBC private label items to give consumers a less expensive option.

Sources: Lil’ Drug Store Products HBC Convenience Trends 13 weeks ending 6/17/2023; AC Nielsen C-Store Total HBC – 13 weeks ending 6/17/2023; Convenience Store News, Industry Report 2023; https://drugstorenews.com/store-brands-shine-consumer-wallets-tighten