By: Howard Riell | March 18, 2024

Dollar and unit sales of salty snacks continue to trend upward even as inflation pushes prices higher.

Despite higher prices, customers are still snacking, and they’re seeking flavor innovation, protein, energy and taste from their snack options.

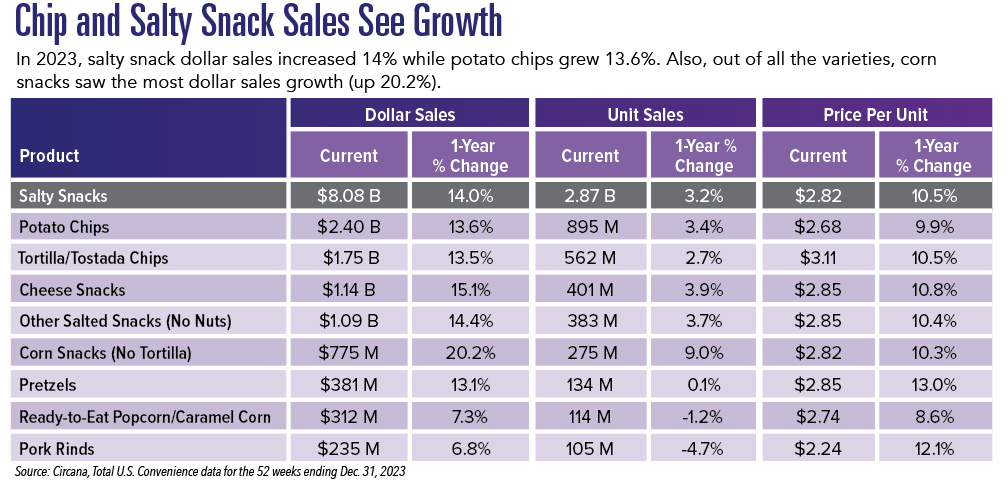

The convenience store salty snack category saw dollar sales of $8.08 billion, a gain of 14%, for the calendar year ending Dec. 31, 2023, according to Circana. Units sold topped 2.87 billion, a rise of 3.2%.

Today’s customers want flavor adventures from the snack aisle. Mintel reported that 23% of chip consumers in the U.S. want more limited-edition seasonal flavors. Demand is also up for health-boosting snacks. Mintel reported that one-third of U.S. customers say snacks with functional benefits are worth the price.

Some 74% of customers refuse to sacrifice taste when buying snacks. Meanwhile, 55% of customers cite protein as the most important nutritional attribute, and 60% want snack products to provide energy, per the fifth annual U.S. Snack Index by Frito Lay.

Pack size trends are also evolving. “The consumer has moved from the take-home packages to the immediate consumable bags,” said Tom Tucker, director of marketing for Maryville, Tenn.-based EZ Stop, which operates 25 c-stores.

“Frito items continue to provide most of our dollar sales and profit dollars,” Tucker said. “We finished 2023 with an 18% increase over prior years with Frito, while the salty snack peg section had a 26% decline in sales. Our top 20 selling Frito items accounted for 47% of the total sales and 53% of the total profit.”

There were only four large bags in the top 20, Tucker added. The remaining bags were $2.49 items.

“Flavors as a percent of the total were evenly divided with the exception of Doritos, which had 35%. Lay’s were at 20%. Cheetos, Funyuns and Ruffles were at 15% each,” he said.

EZ Stop has found that the standard two-fer promotion has become ineffective in delivering enough lift to offset the margin reduction.

“We moved to a product bundle program that has proved itself in building increased take rates and profit,” Tucker said.

The bundles include buying a bottled soda and getting money off a bag of chips, buying chips and getting a bottled soda for a reduced amount, or purchasing a bag of chips and a bottled soda and getting a roller-grill item free.

“Bundling the chips with an item that the consumer would naturally pick up has paid off for us,” he said.

Mastering The Basics

Increasing sales isn’t too complicated, Tucker noted. “These basics have not changed. Employ and train the best people. Have clean, well-organized stores. Price products with the market. Offer a loyalty platform for your customers.”

Bob Phibbs, principal, Retail Doctor Consultancy, said mastering the basics fuels sales and what’s good for the salty snack aisle is good for all other aisles: intelligent store layout. One of the most basic changes that can jumpstart salty snack sales is improved lighting. “Inside the store, you can enhance any merchandise’s visibility and store ambiance with better lighting,” Phibbs said, noting LED lights can reduce electricity costs while highlighting the salty snacks.

Source: CStore Decisions