By: Jennifer Childers | McLane Company Category Data Analyst

According to a report by Fact.MR, the global Jerky snack market will surpass an estimated value of $9.8 billion by the end of 2033. This year, the market stands at a valuation of $5.3 billion, which means the compounded annual growth rate of Jerky from 2023 to 2033 will be +6.3%.

Lead Up to 2023

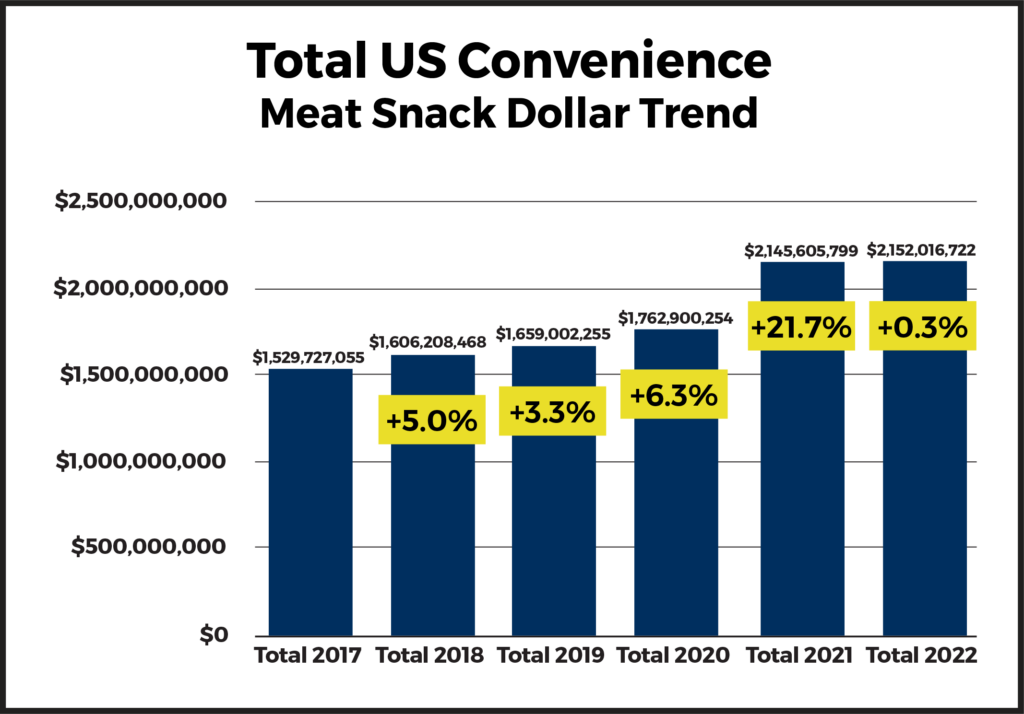

In the Total US Convenience Channel, Meat Snack dollar growth grew +22.1% over 2020, doubling any two-year average. In 2021, the dollar growth was greater than the 3 previous years combined, according to IRI Data.

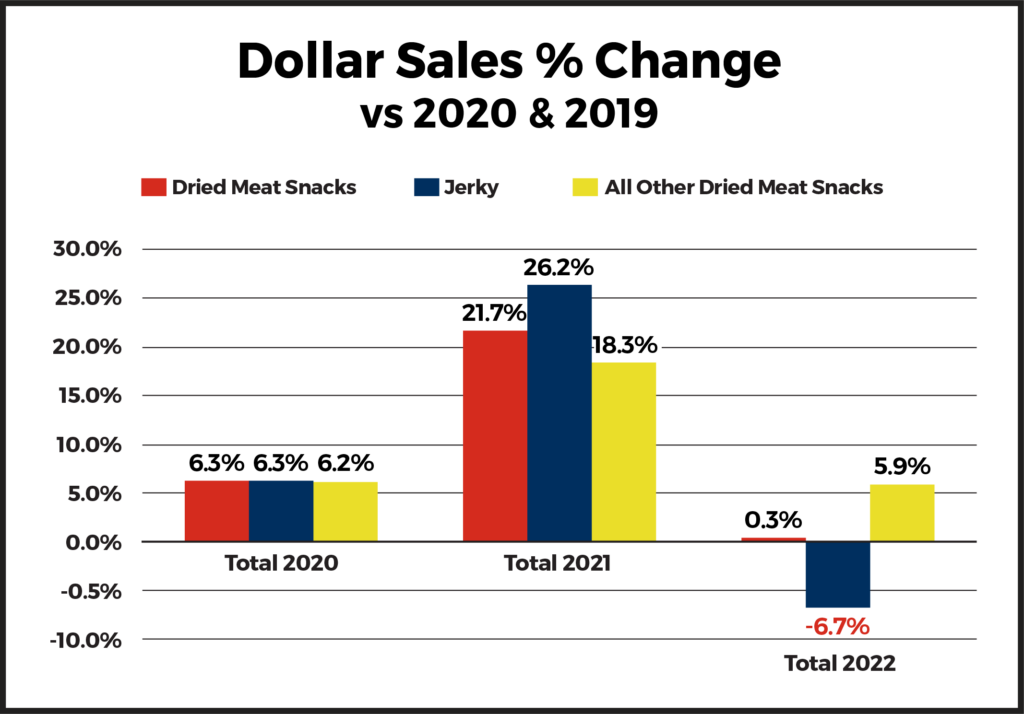

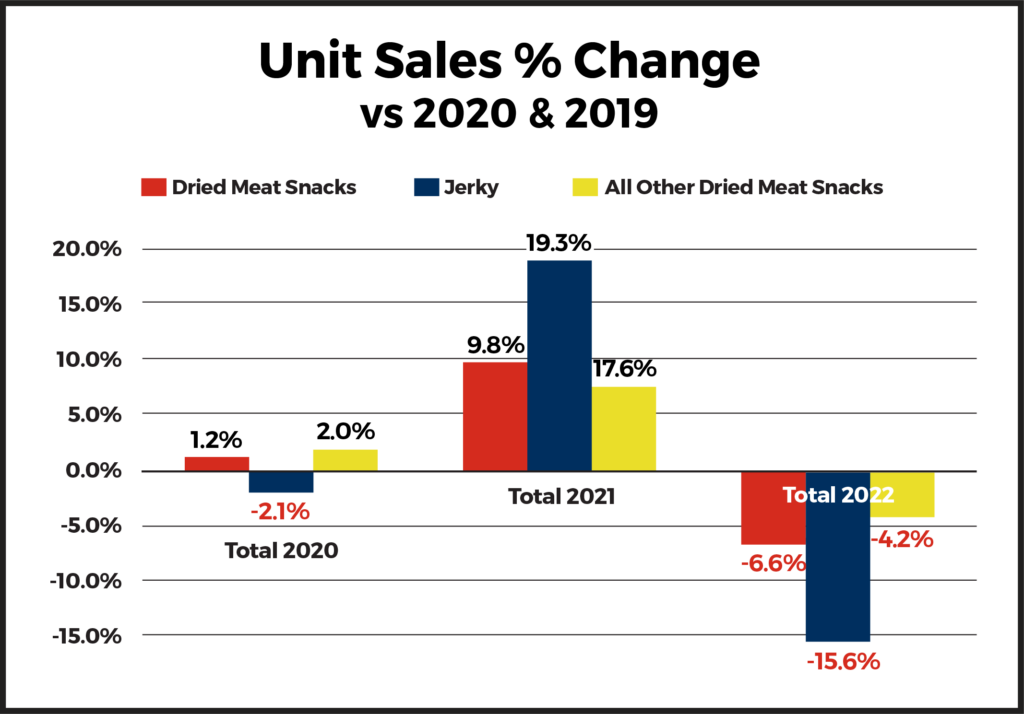

In 2020 all segments had even growth – 2021 the Jerky segment outpaced all other segments and in 2022 we saw the All Other segment outperforming the Jerky segment with one brand being the largest contributor to the Beef Jerky decline.

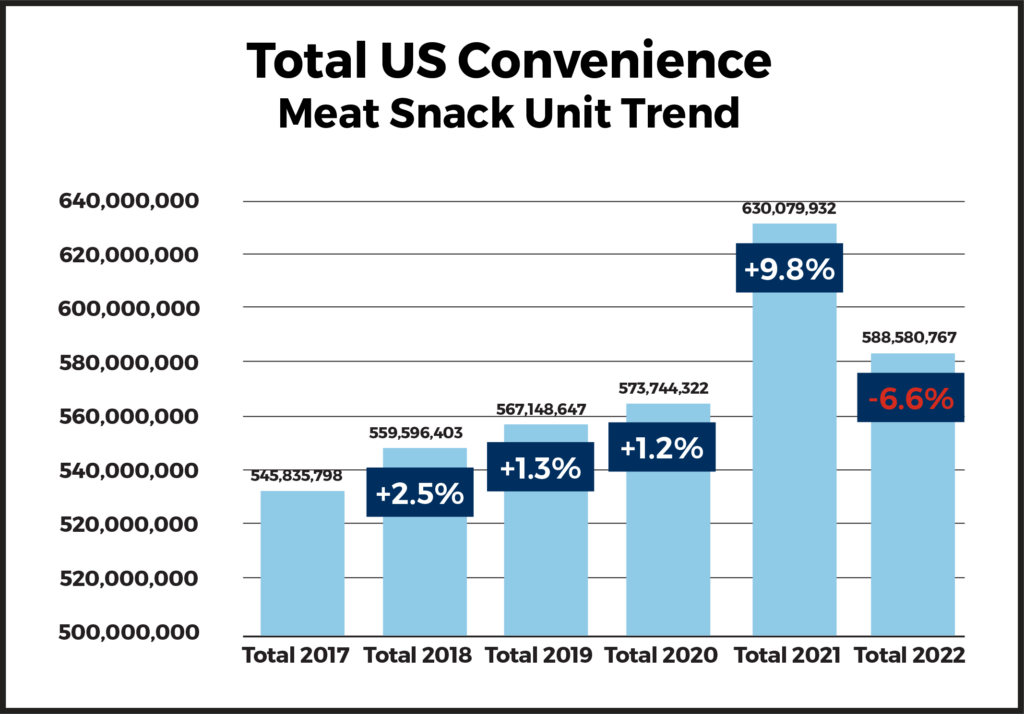

Meat Snack unit sales were down in 2022 vs 2021 but still showed growth of +2.6% over 2020.

Once again in 2021 the Jerky segment drove unit sales with more than double that of the entire category. Even with the decline we saw in 2022, we saw in all segments Meat Snacks’ three-year tread is still supporting unit growth.

Our Take on Meat Snacks

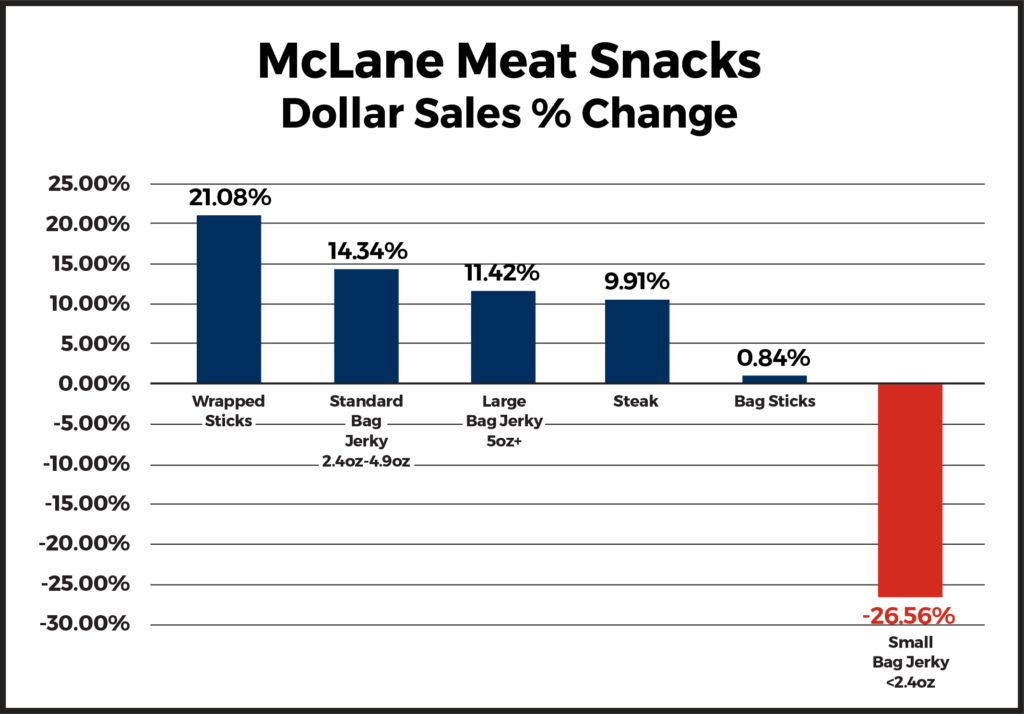

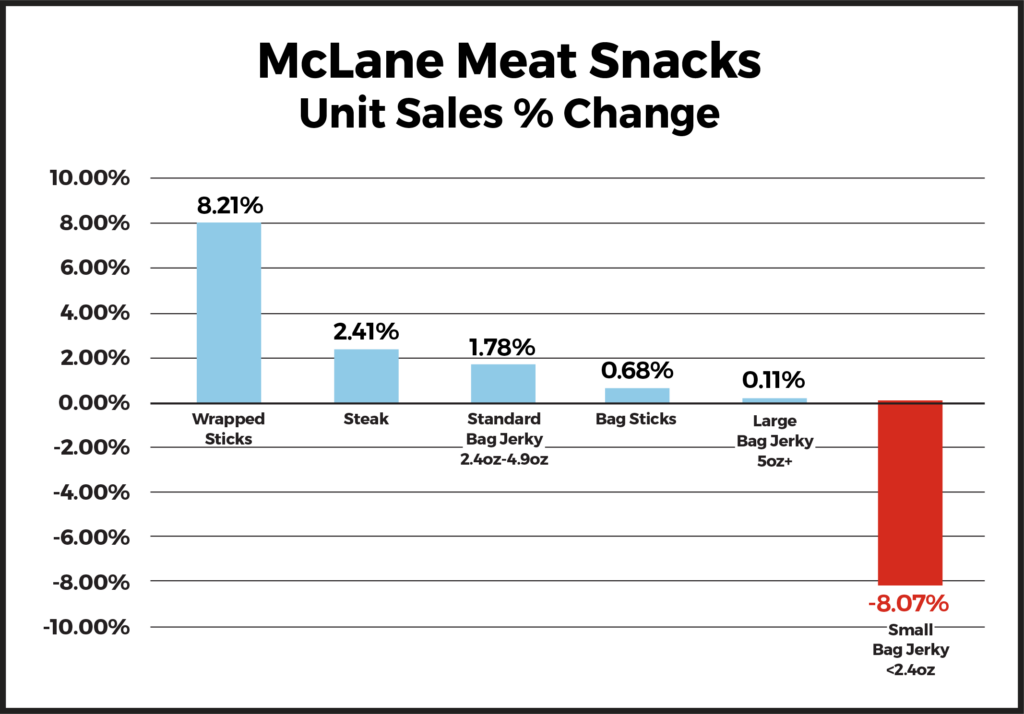

In 2022, McLane Meat Snack dollar growth outperformed the market, up +15.16% and +5.04% in units. All segments were healthy and grew in dollars and units, with the exception of small bag jerky. The small bag jerky segment continued to show declines over the previous year.

Moving into 2023, we have continued to improve growth in Meat Snacks by expanding on our proven core brands. McLane is on the leading edge, bringing new innovation items to this category. Planogram space has been allocated to items that deliver the highest dollar and unit sales. Large bag jerky outperforms its given space and continues to bring higher dollars to the category. New innovation items have been added to the standard bag Jerky and bag Stick segments; including pork and chicken, bringing more variety. These additions should bring new Meat Snack consumers to the category.

This new assortment of core and innovation SKUs will drive the sales in Meat Snacks, and help increase your sales and align with your consumers’ desires.

View the most recent Meat Snacks 6ft POG.

Sources: Old Trapper; IRI Total US Convenience; CSP March 2023; Fact.MR