By: Christine Lavelle | June 13, 2023

Dollar stores show legs with cigarettes, mass merchandisers grow cigars sales

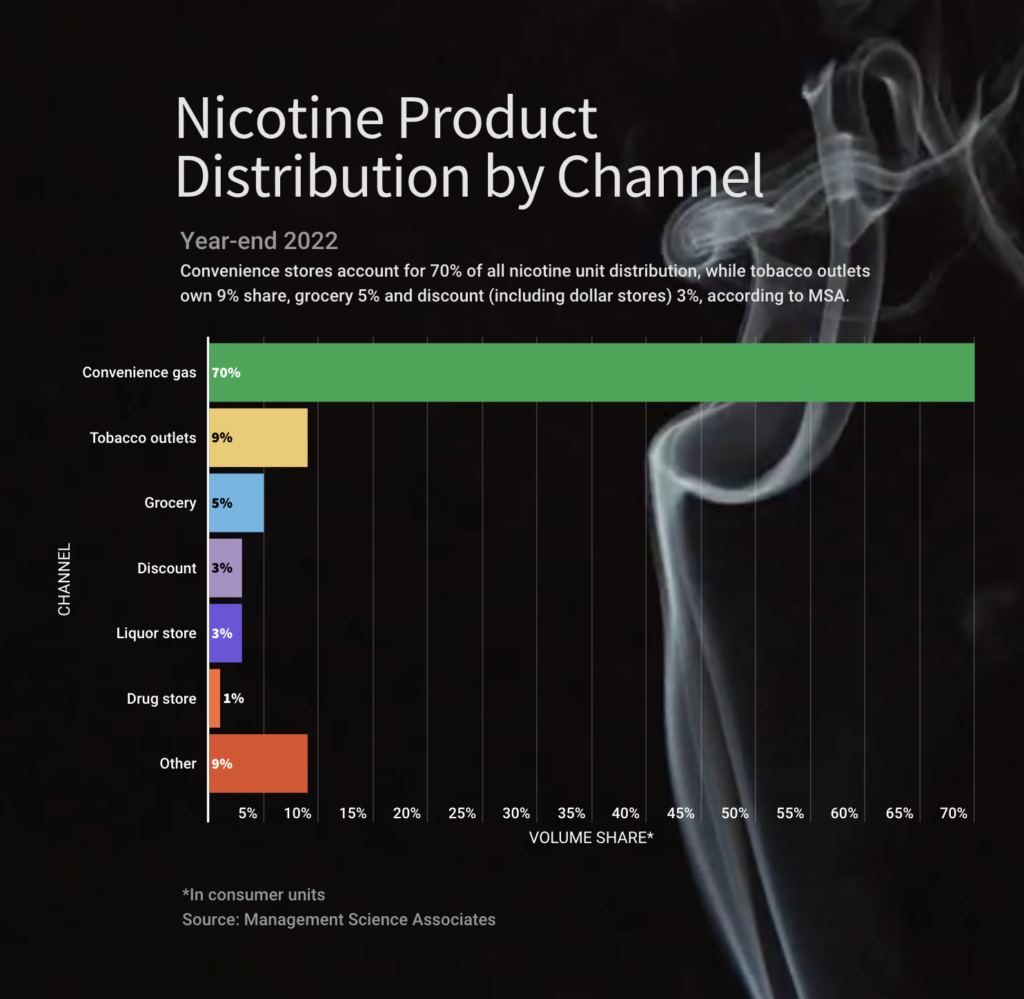

When it comes to satisfying a nicotine craving, convenience stores are still the leading sellers by a wide margin, but data analysts say other channels may be capturing some shoppers and poised to pick up some additional volume.

“We’re seeing some tobacco growth in dollar stores, and it appears to us that dollar stores have refined their product selection to appeal to shoppers most interested in the low-priced items in the category, such as deep-discount cigarettes and the deep-discount moist categories,” said Don Burke, senior vice president of Pittsburgh-based Management Sciences Associates, a data analysis firm that tracks manufacturer shipments.

He also sees consumers challenged by inflation and higher gasoline prices, turning to tobacco outlets that typically sell products at a lower price.

“But convenience-gas continues to do OK because there are so many convenience stores and it’s easy to pop into one to purchase tobacco,” he said.

Smokers Seeking Alternatives

Modern oral nicotine (MON) is a potential growth opportunity for tobacco outlets, Burke said, as many have not yet added the segment. When c-stores were adding modern-oral products, the increased distribution drove category growth at a remarkable rate. Those numbers have attenuated.

“Today, when we look at same-store modern-oral performance in the convenience channel, there continues to be solid growth, although typically more in the single-digit range,” he said. “When you’re building distribution in a trade channel, there is often very strong growth levels.” Burke concludes it is likely the companies that manufacture MON products will begin to build distribution in other trade channels to again achieve strong gains in their business.

Many smokers have been seeking alternatives for years, and it’s no surprise that other tobacco products (OTP) are getting traction.

“Both retailers and the tobacco industry are facing similar moments of disruption,” said Sam Dashiell, senior specialist, U.S. communications for New York-based Philip Morris International. “Today, there are a growing number of new alternatives on store shelves and more innovations on the way for America’s 31 million adult smokers—from nicotine pouches to e-vapor and others—that are better options than continuing to smoke.”

Billy Colemire, director of marketing for Stinker Stores, agrees. “The bright spot for us is OTP,” he said. Traditional tobacco and cigarette sales have continued to decline, he said, with high gasoline prices being an added blow for consumers. “People have less disposable income, and we lost some customers to smoke shops,” he said.

The 110-store Stinker Stores chain based in Boise, Idaho, has seen a lot of success with flavored vapes, as well as higher margins by working with brands that are not part of major tobacco companies. In May 2022, he said, “we launched a lot of new flavored vapes working through some brands that you don’t usually see in a lot of convenience stores.”

- Stinker Stores Inc. is No. 69 on CSP’s 2023 Top 202 list of the largest c-store chains in the country. Lassus Bros. Oil is No. 185.

By partnering with national distributor C-Store Master of Huntsville, Alabama, the chain can pivot quickly as flavor preferences change. “Something that was hot last quarter might not be as hot next quarter,” he said. Using C-Store Master’s scan-based inventory system, the retailer can avoid tying up capital in inventory or distribution tracking.

“We’re starting to see a lot of customers shift more into that flavored-vape space because they know you can get more puffs out of that compared to those traditional sticks,” Colemire said. His newest stores also have space for a 15-foot back bar, so he can dedicate a 3-foot section separate from Big Tobacco contracts.

Colemire said his goal was to sell $1 million worth of products in the first year across all stores. “And we’re closing in on $2 million in sales with a month and a half to the year mark,” he said. “So, we’re outpacing what we thought we would do.”

‘Cigarettes Just Keep Shrinking’

Missy Holley is also seeing growth in vapor, as well as nicotine pouches. “It’s a hard industry right now, for sure,” she said. “Cigarettes just keep shrinking and almost everything else keeps growing.”

The tobacco category manager of Fort Wayne, Indiana-based Lassus Bros. said she isn’t concerned about competition from other channels in her market. Dollar stores, especially, she said “are just a whole different customer.” And as Burke notes, the sheer number of convenience stores vs. other channels keeps c-stores top of mind with tobacco consumers.

“We’re up 7% in vapor and almost 12% in other tobacco products,” Holley said, with cigarette packs down 12% over prior year. She said cigarette sales have not returned to pre-pandemic levels, and “I don’t know that we ever will.” But vapor sales have more than doubled at her stores since 2019, and other products are up 50% versus 2019. Still, she said, cigarette sales are four times those two categories together.

In his remarks during Altria’s Investor Day in March, Scott Myers, president and chief executive officer Altria Group Distribution Co., Richmond, Virginia, offered reinforcement of the dominance of convenience stores in the tobacco category.

There are approximately 25 million tobacco transactions at retail each day, he said, and “75% of tobacco consumers purchase their products at a single preferred store, with most transactions taking place in convenience stores.” His comments to investors did not single out any other channel of trade.

In developing his strategy for vape products, Colemire said most retailers are afraid the FDA or local entities could enact a complete flavor ban.

“Everybody was almost paralyzed with fear of getting stuck with a bunch of products,” he said. He told his team at Stinker they would find a different distribution strategy and put that burden on someone else.

That move has allowed Colemire to turn the tables on other retail channels.

“That’s allowed us to move into spaces that other competitors have in our market,” he said. “And if anything, we’re more in the smoke-shop radar. They took our traditional tobacco business, and now we’re starting to take some of their flavored-vape business.”

Source: CSP