By: Marilyn Odesser-Torpey | March 5, 2024

Customers may choose to purchase certain bakery items from a c-store to treat themselves or others or for health reasons.

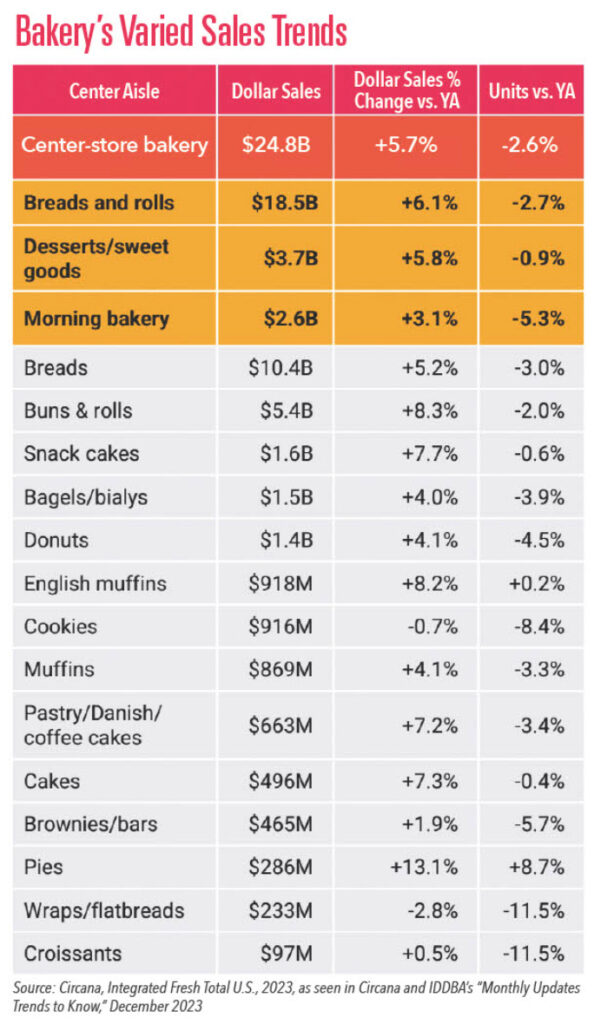

2023 was a “mixed bag” for the bakery category, with dollar sales up 6.3% and unit sales down 2.1%, stated Jack Ince, education coordinator for the International Dairy Deli Bakery Association (IDDBA), quoting data from the company’s Integrated Fresh Data dashboard.

He attributed much of the unit sales drop to inflation.

“Bakery has often been viewed as an impulse buy, which can negatively affect the unit growth,” agreed Whitney Atkins, IDDBA’s vice president of marketing.

The good news, IDDBA reported, quoting a 2023 Circana “Omnibus” survey, is that 30% of shoppers said they continue to make impulse purchases to reward themselves, and 29% said they do it to treat someone else.

C-stores can capitalize on this mindset in 2024 to boost bakery sales.

The survey also pointed out that many of the smaller, handheld items are showing unit growth from last year.

“Doughnuts stand out as a top performer ranking highly for total dollar/unit sales growth percentages,” Ince elaborated.

He continued that cookies, specifically the more modern style of giant, chewy cookies with surprising flavors and over-the-top toppings, have been steadily gaining popularity in the quick-service restaurant dessert world.

“Retail bakeries can absolutely take advantage of this trend,” he said.

At Dysart’s Travel Stops’ nine locations in Maine, cookies baked in the company’s proprietary commissary are a main attraction.

“Pumpkin chocolate chip cookies are our biggest sellers year-round, probably because they’re so unusual,” noted Tim Dysart, vice president of the company. “Chocolate, pumpkin and other flavored whoopie pies are always in high demand, and we can never make enough of our no-bake chocolate and peanut butter cookies.”

Because cookie sales are consistently high, Dysart’s stores offer between eight and nine varieties at any given time. Doughnuts and banana-chip and pumpkin-chip sweet breads, whole or in two-slice packs, are other customer favorites, pointed out Megan Guenther, Dysart’s general manager.

The Health Factor

Another element with an impact on the bakery category is increasing consumer interest in “healthier” products, “although what that means to consumers varies drastically from one to another,” Ince said.

“Many consumers will be drawn to sourdough breads or a seeded loaf, seeing it as a functional food, while others will see an occasional treat like a doughnut as great for their mental health,” he remarked.

Ince stated that portion-controlled treats are attractive to a growing number of consumers. Cupcakes, for example, saw a strong increase both in dollar sales (41.7%) and units sold (8.7%) versus two years ago.

“People don’t bake at home anymore, so there’s always a place for a good bakery,” Dysart said.

Source: CStore Decisions