Purchases of beverages, tobacco, candy and snacks contributed to higher basket rings.

NEWARK, N.J. — NRSInsights, a provider of sales data and analytics drawn from retail transactions processed through the National Retail Solutions (NRS) point-of-sale (POS) platform, found same-store sales increased 7.7 percent year over year (YOY) for the month of June.

As of June 30, 2023, the NRS retail network comprised approximately 25,200 terminals scanning purchases at independent retailers, including bodegas, convenience stores, liquor stores, grocers, and tobacco and sundries sellers nationwide, predominantly serving urban consumers.

[Read more: Food & Beverage Spending Drive Retail Sales Revenue]

Retail same-store sales highlights include:

- Same-store sales increased 7.7 percent YOY (vs. June 2022). Average sales per calendar day for June increased 1.5 percent compared to May 2023.

- Same-store sales in May 2023 increased 7.1 percent vs. May 2022. Average sales per calendar day in May increased 1 percent vs. April 2023.

- For the three months ended June 30, 2023, same-store sales increased 6.2 percent compared to the three months ended June 30, 2022.

- The number of items sold during June 2023 increased 7.3 percent compared to June 2022 and the number of items sold per calendar day increased 1 percent compared to May 2023.

- The average number of transactions per store in June 2023 increased 4.3 percent compared to June 2022 and the average number of transactions per store increased 1.4 percent compared to May 2023.

- A dollar-weighted average of prices for the top 500 items purchased in June 2023 increased 2.9 percent YOY, a slight decrease from the 3.2 percent YOY increase recorded in May 2023.

“Same-store sales by NRS retailers again increased robustly during June, rising 7.7 percent year-over-year, driven by both increased traffic and average ring per basket,” said Suzy Silliman, senior vice president, data strategy and sales at NRS. “Category growth leaders included prepared cocktails (both spirits and wine-based), tequila, smokeless tobacco, packaged cookies, energy drinks and sports drinks, as well as salty snack and candy categories.

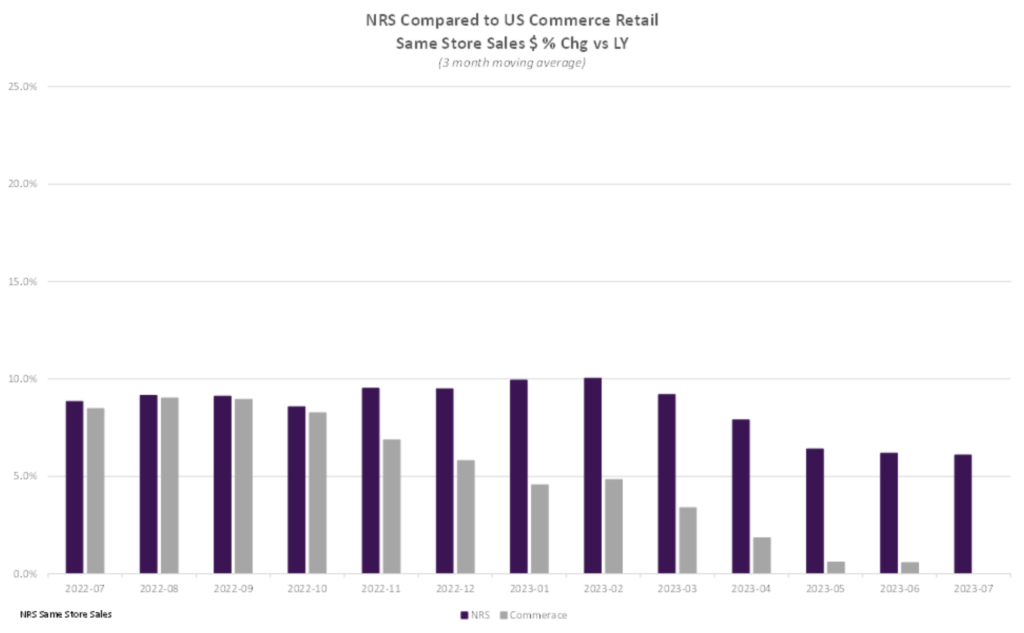

“Our neighborhood retailers’ three-month rolling, year-over-year same-store sales increase of 6.2 percent continues to exceed the U.S. Commerce Department’s comparable retail same-store metric, likely because our sales overweight food, household essentials and other necessities compared to the broader retail marketplace,” she added.

The NRS average three-month moving average same-store sales has outpaced the U.S. Commerce Department’s Advance Monthly Retail Trade data excluding food services by 4.9 percentage points, on average.

The NRSInsights data have not been adjusted to reflect inflation, demographic distributions, seasonal buying patterns, item substitution, or other factors that may facilitate comparisons to other periods, to other same-store retail sales data, or to the U.S. Commerce Department’s retail data, NRS stated.

The NRSInsights monthly Same-Store Retail Sales Reports are intended to provide timely topline data reflective of sales at NRS’ network of independent, predominantly urban, retail stores.

Same-store data comparisons of June 2023 with June 2022 are derived from approximately 148 million transactions processed through the 14,284 stores on the NRS network that scanned transactions in both months. Same-store data comparisons of June 2023 with May 2023 are derived from approximately 204 million transactions processed through 20,883 stores.

[Read more: Convenience Store News Industry Report 2023: Reaching New Highs]

Same-store data comparisons for the three months ended June 30, 2023 with the year-ago three months are derived from approximately 416 million scanned transactions processed through the NRS network in both quarters.

The NRS network comprises approximately 25,200 active POS terminals operating in approximately 21,900 independent retail stores.

Source: Convenience Store News